Hello Ashford Property Investors,

The recent announcement of the extension to the stamp duty holiday has certainly been good news for investors, with the £500k threshold now in place until the end of June; dropping to £250k until the end of September.

I have recently been looking into the impact that this has had on the Ashford property market and have calculated that Ashford Homeowners saved approximately £4.7m in stamp duty between July – December 2020!

Ashford Homeowners Have Saved Approximately £4.7m In Stamp Duty So Far

Office For National Statistics house price data indicates that July to December saw a total of 821 sales and with an average stamp duty payment of £5,802.50 per property (based on the average Ashford house price of £316,050). That is certainly a significant amount of savings that have been made. This, and we are only around halfway through the total duration of the holiday!

So, how does this look if we focus into some specific areas? If we look at Hythe Road, the average property according to Rightmove is £266,571 and this gives a total saving of £3,326.05. For Francis Road, where the average property price is £247,315, this gives an average saving of £2,446.30.

An Increase In Mortgage Borrowing

The extension to the stamp duty holiday has also led to mortgage borrowing reach a five year high, however it is probably no surprise that the average interest rate on newly drawn mortgages has increased by six basis points to 1.91% over the same period.

In addition, This Is Money recently reported that mortgage approvals were up by 38% on a long-term average as just another indicator of what does appear to quickly becoming quite a booming market!

I will certainly be interested to see the effect that the tailing off from the end of June will have and then also from September. I do have a feeling that prices may settle as demand has a dip, however certainly do not anticipate a big drop.

What Does This Mean For Investors?

What does all this mean for investors however? Well, the savings available certainly mean that now is a good time to buy a property that you plan on holding for a long period of time. Even if there is a small dip, the property market is resilient and will certainly bounce back.

In addition to this, I am seeing a growing number of investors either taking the chance to move their portfolios into a limited company or even choosing to exit the market on a high before any potential changes to Capital Gaines Tax are brought in.

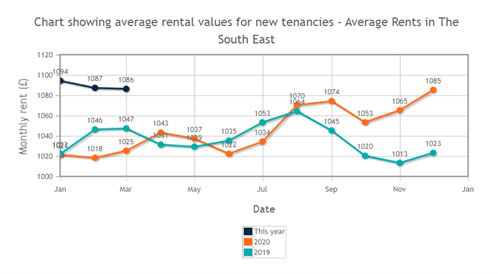

The final point to consider for the buy-to-let investor is the rental market, which does appear to be booming, with an increase in rents as well. According to Home Let, rents for the South East have increased by an average of around £60 per month compared to March 2020; most likely fuelled by an increase in demand.

I trust that you found this article helpful! I run tailored discovery sessions to provide property investors with all the tools they require to either make their first investment, move into a new area, review, or expand their portfolio.

Sessions last two hours, cost £147 and have proved extremely helpful to both novice and experienced investors alike. I also hand out a copy of my book the HMO Crash Guide (currently at 13,000 words).

I’ve conducted around a dozen of these since I launched this service around this time last year. You can find out more and book a session here.

Hasan