Hello Ashford Property Investors,

As the country begins to open back up, we are beginning to gaze at our crystal balls to see whether we can catch a glimpse of all that the property market holds over the next six months. The start to the year has, on the whole, been positive for property investors, with prices starting to level off a little and rents holding out. It will be interesting to see if this continues!

With this in mind, I have been speaking with several investors over the past week and a hot topic has been the question: “Where should I invest?!” Price, demand, yield, and ROI are important factors and an excellent way to assess this is through heatmaps.

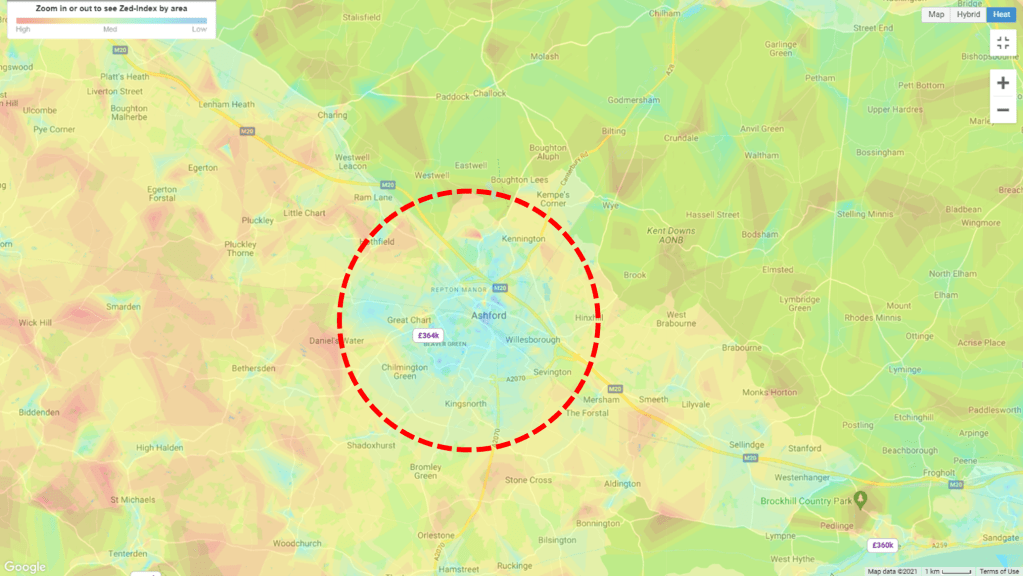

I have come across some excellent heatmaps demonstrating how affordable Ashford is in comparison with surrounding areas. The map below illustrates this; the darker shaded areas reflect a higher price and Ashford really does stand out!

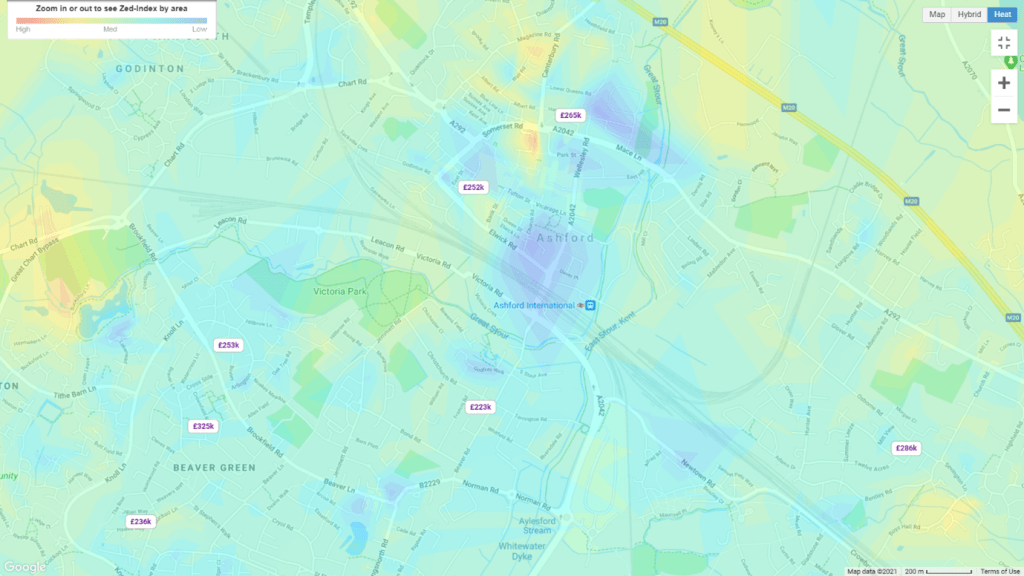

What makes this particularly interesting is how, when you zoom in, it appears that properties around Ashford International Station are slightly cheaper than areas further out. This is an interesting statistic as it is often the other way round!

Zooming in a little more, the average price for a terraced house in Apsley Street, Ashford which is fairly near the station is £186,225 (7.81% increase over the past 12 months) and Mace Lane, which is slightly further out from the station has an average property value of £293,595 (9.8% increase over the past 12 months).

These prices compare to properties on the outskirts of Ashford being valued at around £305,150 for West Street, Hothfield (6.71% increase over the past 12 months) and Forge Hill, Aldington being £318,017 (9.64% increase over the past 12 months).

This is particularly interesting as in more built-up areas, property prices in the town centre or near transport links do tend to be higher than on the outskirts. However, considering that Ashford is much more rural, it may simply be that the properties on the outskirts tend to be larger, with more land and therefore command a higher price.

“What of demand in HMO market?” I hear you ask! Well, with exciting new developments such as the South Of Ashford Garden Community and Newtown Works, there is a lot of future potential and investment in the area. For the HMO investor, this makes Ashford an extremely attractive option.

Looking forward, it will be interesting to see what the Ashford property market looks like when we hit 2030!

According to data from The Land Registry, the average price of a terraced house in Ashford is £247,936 and this compares to £268,018 for Kent in general. If we use the same growth we have seen since 2012 (68%) and project this forward, we could be looking at values of £416,532. I’m not sure if this trend will continue, however it will certainly be interesting if it does as it is a staggering average monthly growth of around £1,500!

The lower average prices for Ashford central, mean that investors require less cash upfront and therefore can achieve some excellent returns with lower barriers to entry!

I trust that you found this article helpful! If you are considering an Ashford property investment, I will be more than happy to assist as and where you need it.

I run tailored discovery sessions to provide property investors with all the tools they require to either make their first investment, move into a new area, review, or expand their portfolio. Sessions last two hours cost £147 and have proved extremely helpful to both novice and experienced investors alike. I also hand out a copy of my book the HMO Crash Guide (currently at 13,000 words).

I’ve conducted around a dozen of these since I launched this service around this time last year. You can find out more and book a session here.

Hasan