Hello Ashford Property Investors,

When investing in property, it is important to have a strong knowledge of the area that you are looking at purchasing in so you can determine things such as demand, yields and house price growth etc.

Very often, people tend to look at a town, however from my experience there can be areas within a town that perform better than others and it is therefore important to have a good understanding of the market at a more granular level.

An example of this is how, from personal experience, I know that some areas within Ashford are better to invest in than others. These areas do tend to differ when looking at an HMO, single let or serviced accommodation.

I have recently been spending time looking into this and come across some very interesting data that reveals everything investors need to know about prices, rents, yields and more within Ashford by postcode sector. This data is a bit of a goldmine and I hope you find it helpful!

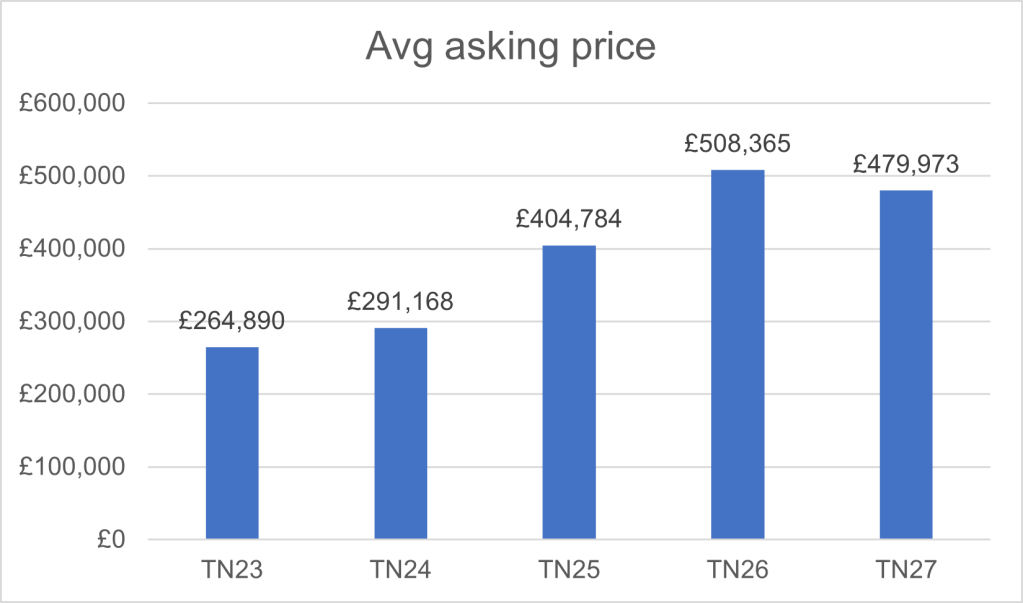

Average Asking Prices

When looking at average asking prices, there is a significant difference between the cheapest average prices in TN23 and the highest average prices in TN26.

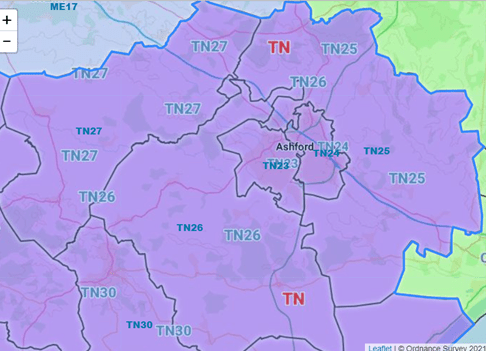

There is a marked split between TN23 and TN24 compared to TN25, TN26 and TN27. The map below indicates how TN23 along with TN24 are more central and the remaining postcode sectors form a rural belt around the town.

When looking at properties for sale, those outside of the town generally tend to come with a significant amount of land and four or five-plus bedrooms. This data also matches what I looked at in my last blog which covered how properties in central Ashford tend to be cheaper than the surrounding areas.

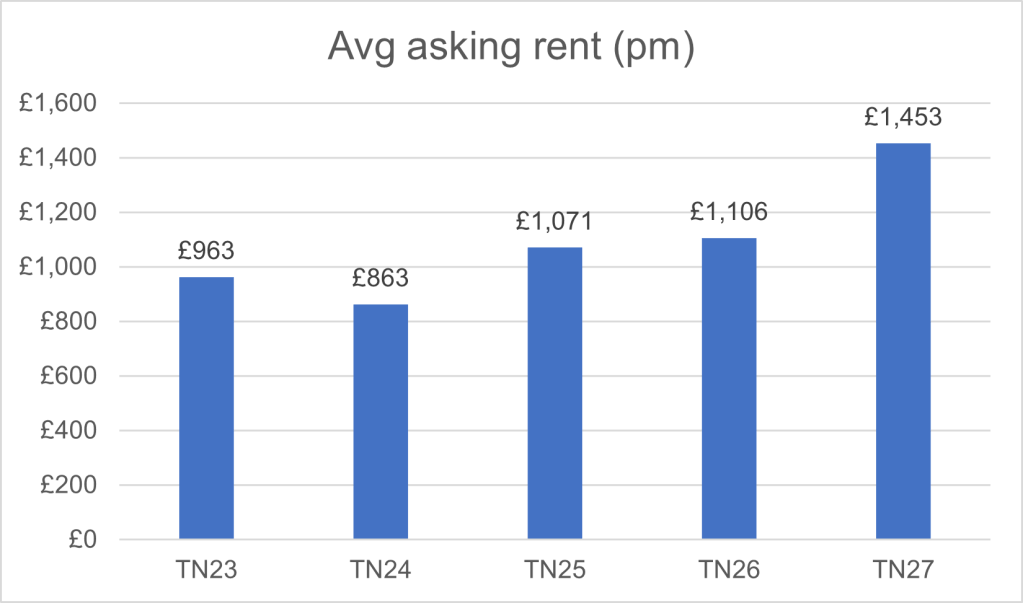

Avg Asking Rent

When looking at rents, the average sits at around £1,091 per month, however, there is some degree of variation.

I have calculated TN26 and TN27 as an average based on the total available let properties according to Rightmove which, for TN26 is 16 properties from November 2020 to date and TN27 just 13 properties from July 2020 to date. As these areas tend to be larger houses, it is probably no surprise that there is a marked difference.

Rents have significantly increased over the past 12 months and this has simply been led by a surge in demand as COVID-19 has begun to affect the property market. The Medway Towns have seen overall rental increases on average of £86 per since April 2020!

I have broken this down in the table below and it is interesting to see how TN23 stands out. There was a lack of data for TN26 and TN27, most likely due to the reasons outlined above.

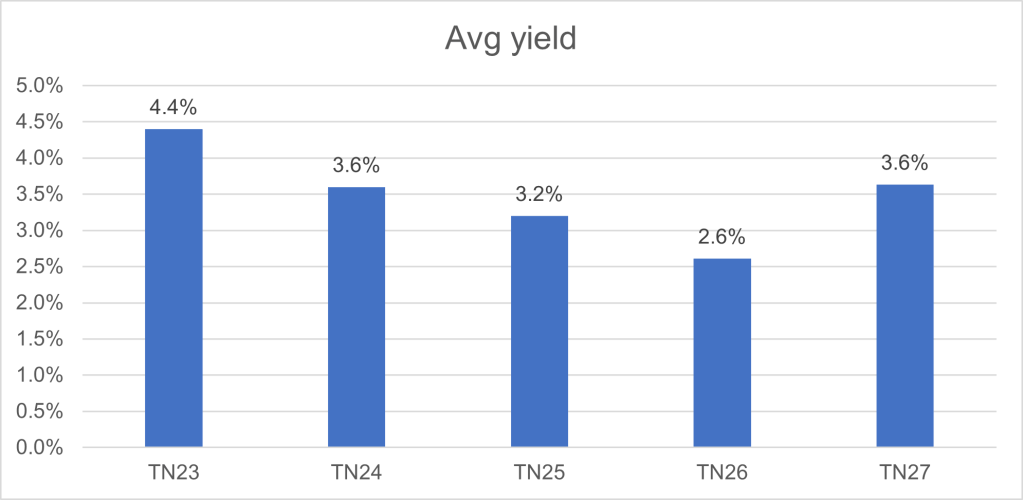

Avg Yields

So, what of average yields? TN23 stands out here at 4.4% average yield due to a strong mix of property price and rent.

Using this data, on average you are looking at an average yield of 3.5% for Ashford, however if we discount TN25, TN26 and TN27, we have 4% average yield, compared to 3.7% across each postcode sector for the UK as a whole.

Based on this statistic, investing in TN23 and TN24 tends to get you an 8% better yield than the current UK average!

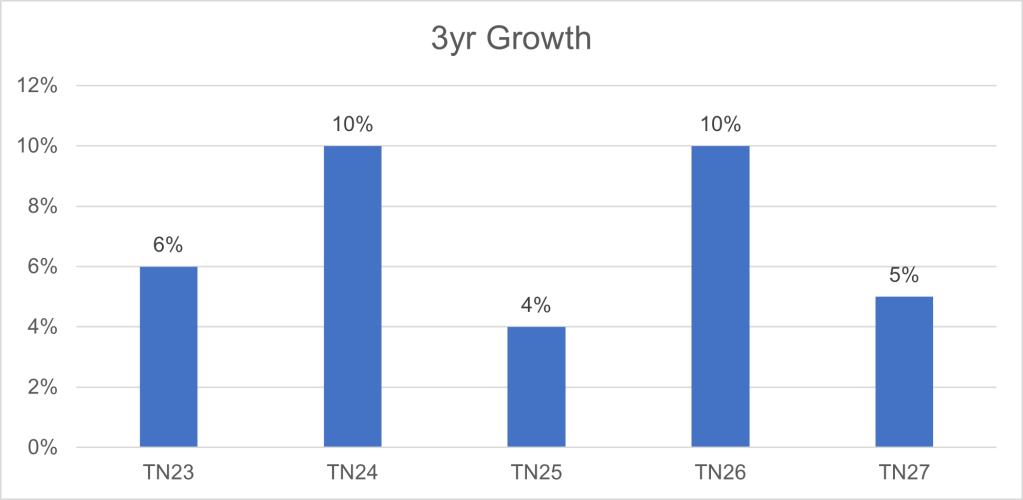

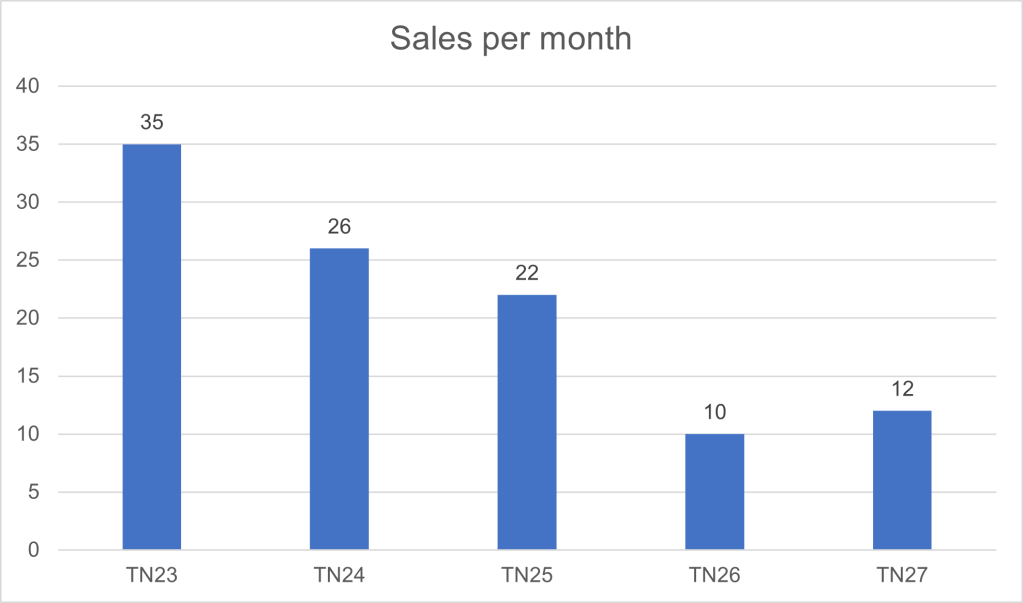

Sales And House Price Growth

This statistic is very interesting as whilst Ashford has seen house price growth of around 7% over the past three years, this is significantly different if you look at each postcode sector.

I would take this data as being more indicative than absolute and there will certainly be a delayed effect due to the length of time it is taking for sales to complete.

TN23 & TN24 stand out again as they not only have a strong yield and lower prices, but have also seen some strong growth. I would certainly be thinking about these two areas if I were looking to make an investment based on these statistics!

I do know a number of landlords who have seen significant growth across all postcode sectors, so this statistic may be hampered by the number of sales per month in each area.

I trust that you have found this article helpful. I will be spending some time looking into demographics data in my next blog ad reflecting on how this impacts the rental market as well as looking at data relating to HMOs.

If you are considering a property investment and would like to find out more, remember that I run tailored discovery sessions to provide property investors with all the tools they require to either make their first investment, move into a new area, review, or expand their portfolio.

Sessions last two hours, cost £147 and have proved extremely helpful to both novice and experienced investors alike. You can find out more and book a session here.

Hasan