Hello Ashford property news readers,

With the lasting changes following COVID-19 such as what is looking to be a permanent hybrid-working style for many, I am keeping a close eye out to see what areas ones are to keep an eye on for future potential HMO growth and Ashford does seem to be one to watch!

But why is this? Well, a good place to start is comparing the current demand verses supply for rooms and according to SpareRoom, Ashford has 33 rooms available and 49 people looking. That is a 148% demand for the currently available rooms, with 1.5 people looking for every room available.

If we compare this to, say, Canterbury (which has a larger population) there is a total of 244 rooms available, with 252 people looking meaning the ratio of demand to supply is much lower at 103%. Interestingly, Ashford is comparative in terms of the demand to supply ratio to areas such as Maidstone (150%) and Medway (131%) which are strong areas for HMO investors.

In addition to this, things such as the high-speed rail link from Ashford International station and ability to be in the centre of London in just 40 minutes along with exciting new developments including The South Of Ashford Garden Community, Hinxhill Park, Bilham Farm, Sevington Lakes and more help demonstrate how the area is becoming all the more attractive.

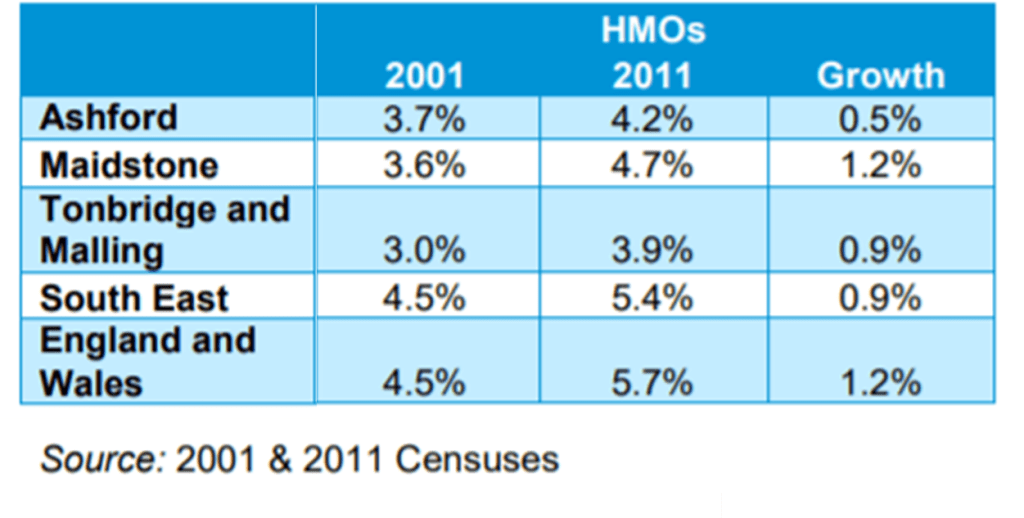

Whilst slightly older data, the last census helps shed additional indication to the level of HMO market growth and I will be publishing a more up to date comparison following a recent Freedom of Information request to Ashford Borough Council to see if this growth has continued on the same trajectory.

My opinion is that investors should always take time to do their research when investing in a new area and as Ashford is one of the most rural areas of Kent with just 6.1% of land developed, it is even more crucial to choose the right areas within the town to invest in.

Whilst this large area of undeveloped land is either agricultural or green belt, a staggering statistic is how Ashford has seen the largest population surge since the 2001 census, with 15,000 new residents and an overall population rise of 14.6%. If this is not one of many positive signs of future potential, then we are certainly missing something!

One of the skills of investing in property is identifying up-and-coming areas, purchasing before they shoot up and then benefiting from the growth. I regularly work with investors to provide advice and guidance that ensures they are on the right track and if you have any questions then I would be more than happy to help. The best way to reach out is via LinkedIn.

Hasan