Hello Ashford Property Blog readers!

It is coming to that time of year when we are all gazing into our crystal balls asking ourselves what the next 12 months will bring for property investors.

Looking back, 2021 has certainly been a year of two halves and if you cast your mind back to December 2021, we were amid another wave of COVID-19 with lockdowns, cancelled Christmases and more on the cards.

For the majority of the first 4-6 months of the year, COVID-19 led to ongoing restrictions and more. Whilst we have seen the resurgence of this in recent weeks, I personally think we are over the worst.

Looking back over the past year, I have to say that Ashford property investors have, overall, had a pretty good ride. House prices are up more than they have been in recent years meaning that additional funds may be released for further investment, tenant demand has been at an all-time high and a growing appetite by the mortgage lenders to loan.

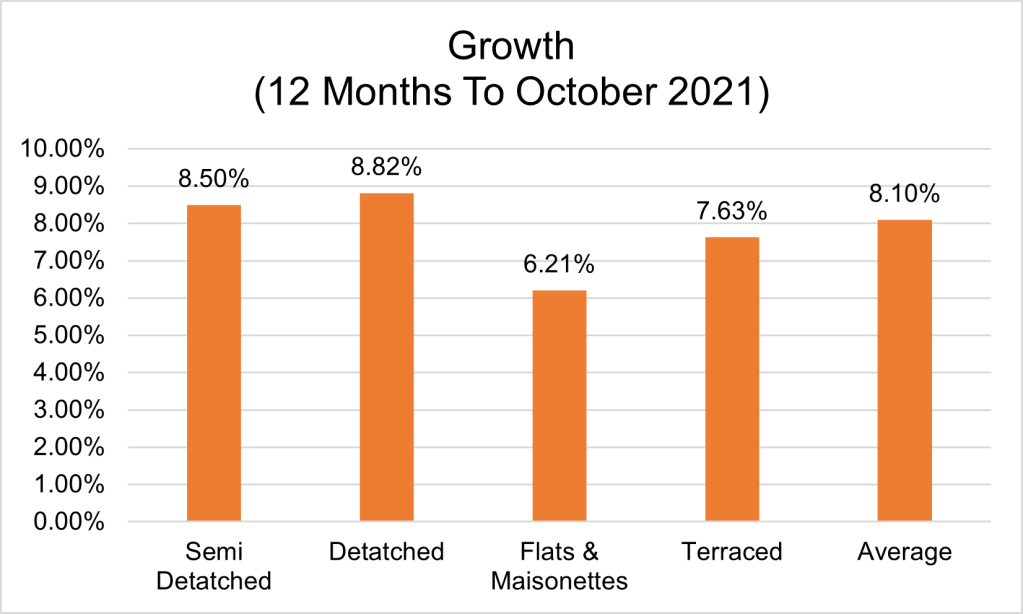

Specifically looking at Ashford, property prices have increased by 8.1% on average over the 12 months leading up to October 2021, however for semi-detached and detached houses, this has hit 8.5% and higher.

Ok, so this may be below the UK average of 10% but it is the best growth seen since the last peak of January 2017 where prices grew by 12.5%.

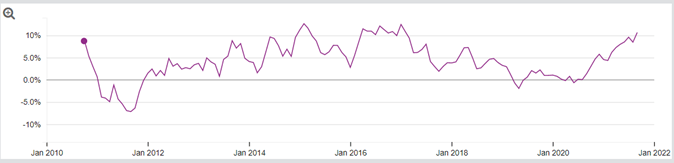

Dare I say the word ‘Brexit’, however when we look back over the past 4-5 years, Ashford has seen pretty low numbers in terms of property growth as the chart below shows.

In May 2019 we were in the midst of Brexit Chaos as Theresa May failed to get agreement on the fourth version of the Withdrawal Agreement and it’s no doubt that this had some impact on the negative growth that the Ashford market experienced. It wasn’t until July 2019 that the market returned to growth; tying in with when Boris Johnson became Prime Minister.

Interestingly, this trend was mirrored in nearby Folkestone & Hythe.

The next disaster to hit was the outbreak of COVID-19, just after the market started to recover, however, the stamp duty holiday and demand since has fuelled the Ashford market leading to it achieving strong growth.

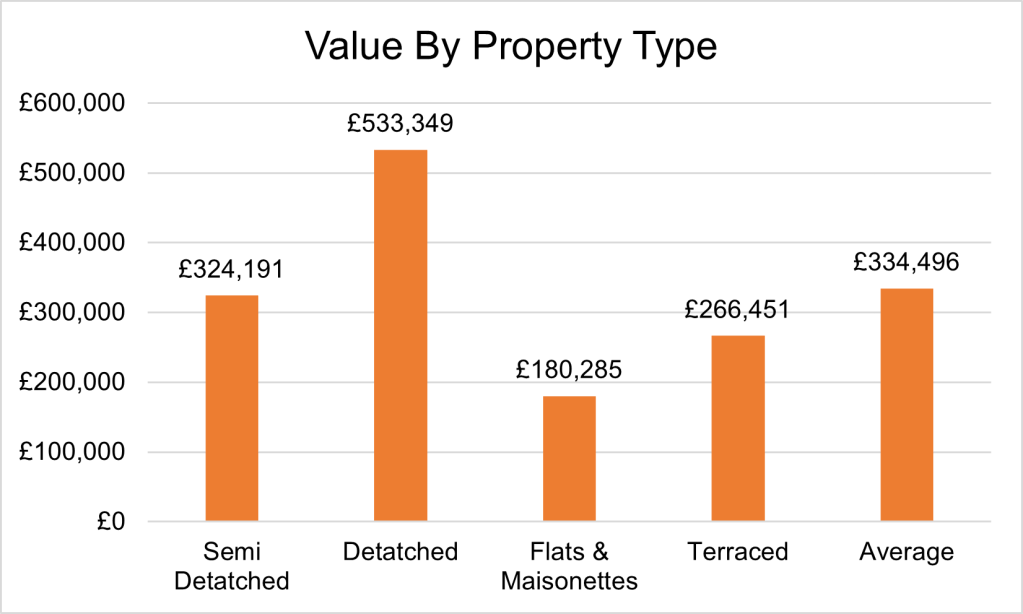

Ashford can be a challenging market to get quality data on because the large swathes of rural areas occupied by high-value properties and low sales volumes can skew the figures, however, I have outlined the current property values in the graph below.

The age-old question is what does 2022 bring? Well, I personally thin that the levels of growth in Ashford certainly still have some way to run and whilst I don’t think we will see a huge rise in terms of the percentage growth figures, I do anticipate that it will plateau off; certainly, sitting well above pre-pandemic levels.

The one to watch is how increases to interest rates could have an impact. I anticipate that this would certainly leave less money in people’s pickets at the end of the month, and it could, just possibly, dampen the market as people have less disposable income. We will certainly see!

I personally think that 2022 will be another strong year for investors. It could prove to be more challenging to find good deals, however they will be out there. The positive thing is that I don’t anticipate any major legislative changes taking place over the next 12 months.

We’ve seen how the treasury has rejected proposals to hike Capital Gains Tax so this is kicked into the long grass and the only other changes we may get brought up to date on will be the renters reform bill and, hopefully, some clarity around the proposed minimum EPC changes. However, none of these coming into force during the next 12 months.

If you are considering making a property investment in Ashford or expanding your portfolio in the area, I am here to answer any questions you may have.

The best way to reach out to me is via LinkedIn.

Hasan